Investing during a bear market can be a daunting task. When the market is in decline, even seasoned investors can find themselves second-guessing their strategies. However, a bear market is not necessarily a time to retreat but can be an opportunity for savvy investors who know how to navigate it. In this article, we’ll explore four strategies to consider when investing in a bear market, aiming to turn adversity into advantage.

Dollar-Cost Averaging: The Long-Term Game

Dollar-cost averaging is a strategy where you invest a fixed amount of money at regular intervals, regardless of the market conditions. This approach allows you to purchase more shares when prices are low and fewer when they are high, effectively lowering the average cost per share over time.

The advantage of this strategy is its simplicity and its focus on long-term growth. It removes the need to time the market and reduces the impact of volatility. This can be particularly beneficial in a bear market, where stock prices are generally declining but can still be subject to significant short-term fluctuations.

Dividend Reinvestment: Grow While You Wait

In a bear market, dividends can be a reliable source of income, especially when capital gains are hard to come by. Instead of taking dividends as cash payouts, consider reinvesting them to purchase additional shares. This can be done automatically through a Dividend Reinvestment Plan (DRIP).

By reinvesting dividends, you’re applying a form of compound growth, as the dividends you earn generate their own dividends in the future. In a bear market, you’re likely to acquire these additional shares at a lower price, setting the stage for higher returns when the market eventually rebounds.

Value Investing: Buy Quality at a Discount

Bear markets often offer the opportunity to invest in high-quality stocks at discounted prices. Value investing involves identifying such stocks—those with strong fundamentals that are undervalued by the market. This strategy requires a good understanding of financial statements, as well as the discipline to ignore market sentiment.

The key to successful value investing is patience. It may take time for the market to recognize the true value of the stocks you’ve chosen, especially in a bearish environment. However, once the market turns, these stocks are likely to outperform, making your patience worthwhile.

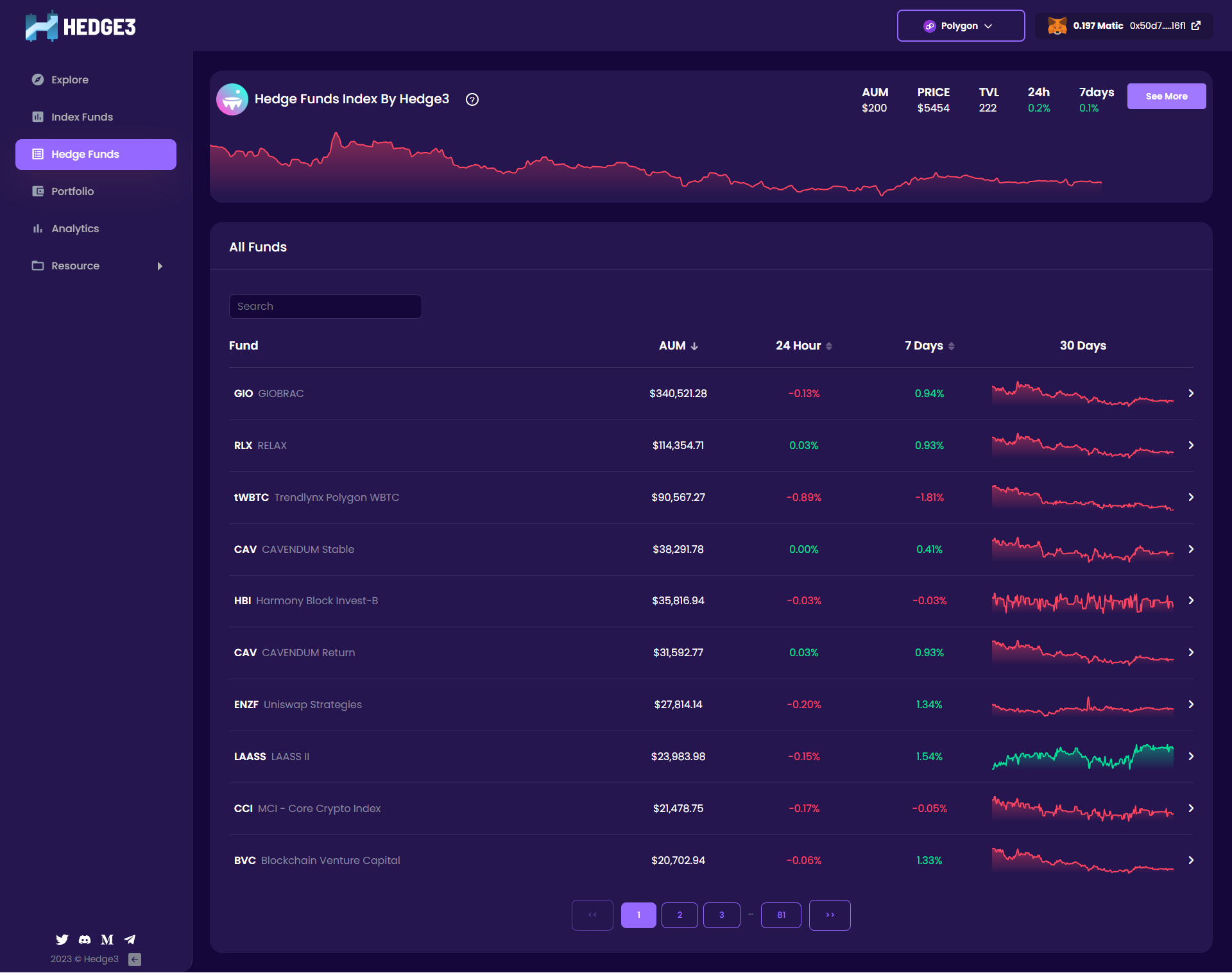

Hedging: Protect Your Investments

Hedging involves taking an investment position intended to offset potential future losses in another investment. This could involve options contracts, futures contracts, or other derivatives. For example, if you hold a significant position in a particular stock that you believe will decline in a bear market, you might purchase a put option to offset potential losses.

It’s essential to note that hedging is not about making money but about protecting it. The cost of the hedge, whether it is the premium paid for an options contract or the expense of holding a less volatile asset, should be weighed against the potential benefits of risk reduction.

Conclusion

Investing in a bear market can be challenging but also rewarding for those who know how to adapt their strategies. Dollar-cost averaging offers a hands-off approach to weather market storms, while dividend reinvestment can provide both income and future growth. Value investing allows you to acquire quality stocks at a discount, and hedging can protect your portfolio from further declines. Each of these strategies has its own set of risks and rewards, so it’s crucial to consider your financial goals and risk tolerance before making any investment decisions.