In the rapidly evolving world of decentralized finance (DeFi), Hedge3 stands out as a pioneering force with its unique DeFi marketplace and Software as a Service (SaaS) solution. This innovative platform is not just redefining the landscape for asset managers but also enhancing the way investors interact with DeFi markets. Let’s delve into how Hedge3’s SaaS solution and marketplace synergize to create a seamless, efficient, and accessible DeFi ecosystem.

The Hedge3 SaaS Solution: A Game-Changer for Asset Managers

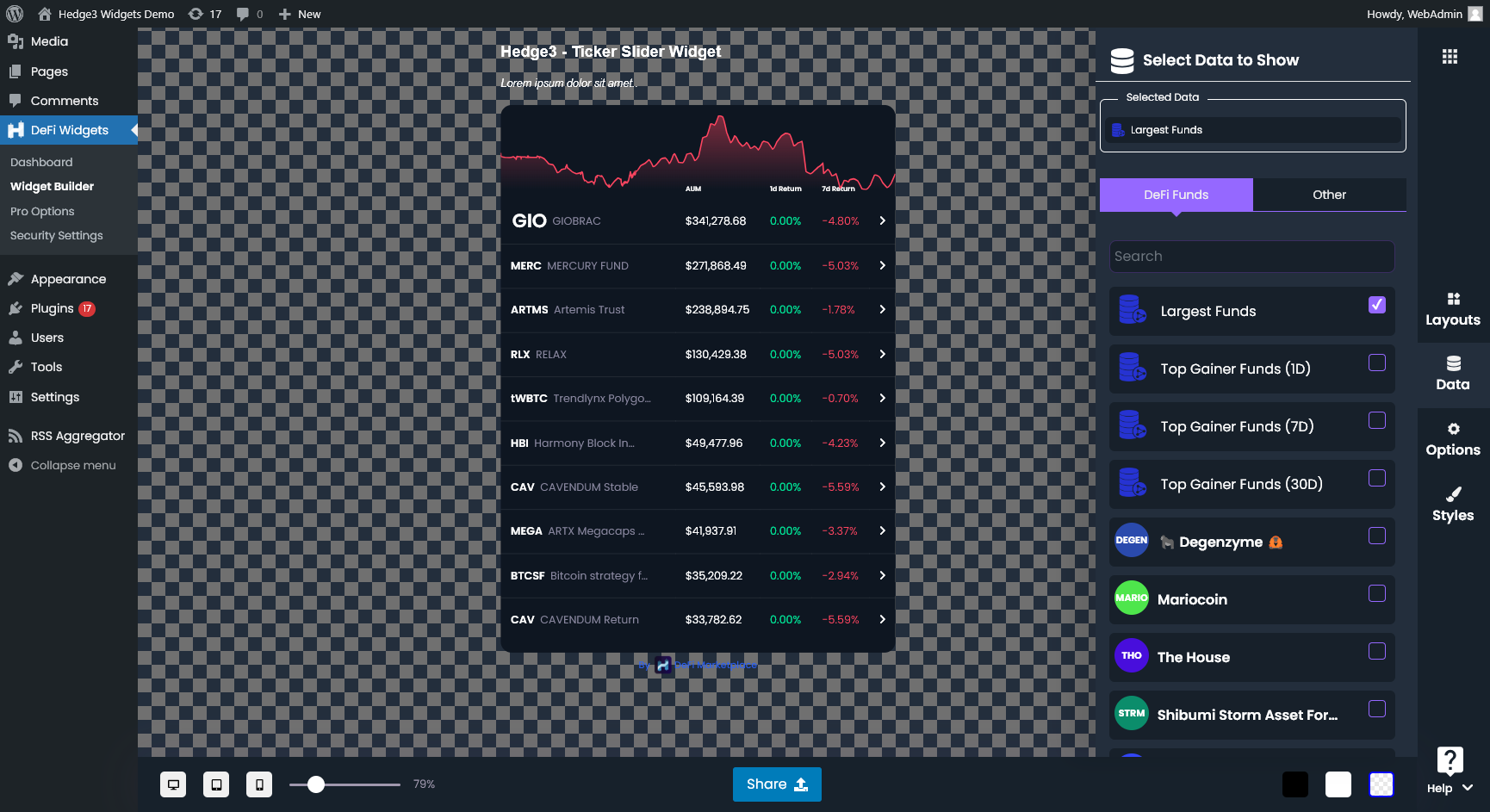

Hedge3’s SaaS offering is a powerful tool designed specifically for asset managers. It provides an intuitive builder for creating decentralized applications (dApps) that operate atop leading asset management protocols like Enzyme Finance and dHEDGE. This enables asset managers to craft bespoke investment strategies and products, leveraging Hedge3’s advanced technology to navigate the DeFi space effectively.

The platform’s ease of use, coupled with its deep customization capabilities, ensures that asset managers can tailor their offerings to meet the specific needs of their investors. From structured data points to live editing features, Hedge3’s SaaS solution prioritizes flexibility, security, and efficiency, enabling asset managers to focus on what they do best: managing and growing their clients’ portfolios.

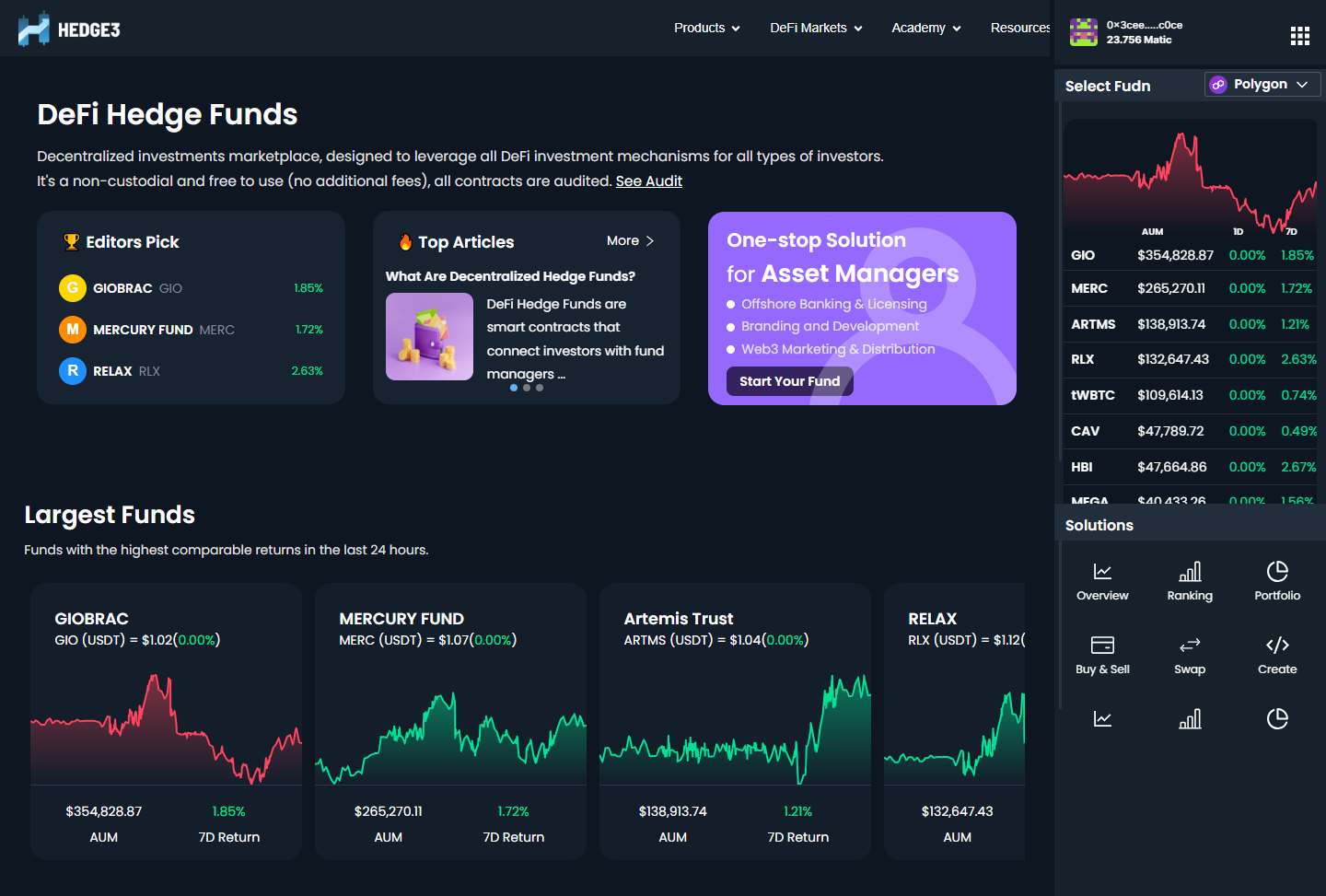

The Hedge3 Marketplace: Bridging DeFi and Investors

Parallel to its SaaS solution, Hedge3 hosts a dynamic marketplace that aggregates a wide array of DeFi funds and investment opportunities. This marketplace serves as a vital link between asset managers and investors, providing a transparent and accessible platform for exploring and engaging with DeFi investments.

Marketplace widgets, a standout feature of Hedge3, can be distributed across any platform, enhancing the visibility and accessibility of asset managers’ offerings. These widgets are designed to showcase real-time, concise data on a variety of assets and investment strategies, from top lists and trading widgets to DeFi galleries and fundamental data insights. With the added capability to customize and brand these widgets, asset managers can maintain their unique identity while leveraging Hedge3’s extensive reach and technology.

A Unified Vision: The Future of Hedge3’s SaaS and Marketplace

Looking ahead, Hedge3 is set to further integrate its SaaS solution with the marketplace, offering asset managers unprecedented opportunities to innovate and expand their product offerings. The roadmap includes enabling asset managers to create and publish index tokens, structured products, and a broader array of investment vehicles directly on the marketplace.

This forward-thinking approach will not only streamline the process of bringing new investment opportunities to market but also significantly broaden the range of options available to investors. By simplifying access to complex DeFi strategies and enhancing the overall user experience, Hedge3 is poised to accelerate the democratization of finance, making it more inclusive, transparent, and accessible to a global audience.

Conclusion

Hedge3’s SaaS-enabled DeFi Marketplace is at the forefront of a revolution in financial technology. By empowering asset managers with sophisticated tools to create and manage dApps and offering a marketplace that connects them directly with investors, Hedge3 is breaking down barriers and setting new standards in the DeFi ecosystem. As the platform continues to evolve, its commitment to innovation, security, and user empowerment will undoubtedly shape the future of decentralized finance.