Decentralized Finance (DeFi) has been making waves in the financial world, offering more inclusive, secure, and versatile solutions. One of the most lucrative opportunities within this sphere is the development of DeFi aggregators. These platforms consolidate various DeFi services—like DEXes, lending protocols, asset management funds, yield generators, LP pools, and staking platforms—into a single interface. If you’re looking to build a DeFi aggregator, you’re in the right place. Below, we outline key steps and best practices, along with how Hedge3 can make this journey easier for you.

Understand the Market Needs

The first step in creating a successful DeFi aggregator is understanding the specific market needs and gaps you aim to fill. This could range from providing better liquidity options to simplifying complex yield farming strategies. It’s essential to conduct market research, look into user behavior, and understand the problems currently faced by users in the DeFi space.

Once you’ve identified these needs, the next step is to refine your value proposition. What sets your aggregator apart from others? Maybe it’s the user experience, or perhaps it’s the variety of services you intend to offer. Make sure you have a clear understanding of what makes your platform unique, as this will guide all subsequent steps.

Select the Services to Aggregate

After you’ve identified the market needs, the next crucial task is to select which DeFi services you will aggregate. The DeFi universe is vast, encompassing services like Decentralized Exchanges (DEXes), lending platforms, asset management funds, yield aggregators, LP pools, and staking platforms. Each of these serves a particular need and comes with its own set of complexities.

Your selection should not only align with the market needs you’ve identified but should also synergize with one another to offer a comprehensive DeFi solution. For example, if you choose to aggregate DEXes, it might also be beneficial to include yield aggregators that can optimize the tokens gained from trading.

Design the User Interface

An intuitive user interface (UI) is essential for the success of any DeFi aggregator. The UI should be designed to make complex processes simple and accessible, even for those who are new to the DeFi space. This involves thoughtful layout design, straightforward navigation, and clear calls to action.

Moreover, since you’ll be aggregating various services, it’s vital to present these in a way that doesn’t overwhelm the user. Group similar services together and offer search and filter options to make it easier for users to find what they’re looking for. Remember, the aim is to provide a one-stop solution that simplifies the user’s interaction with various DeFi services.

Implement Smart Contracts

Smart contracts are the backbone of any DeFi platform. These self-executing contracts handle the logic for all transactions and interactions on your aggregator. Therefore, they must be robust, secure, and efficient to ensure seamless operations and user trust.

Before deployment, these contracts must be audited by third-party services to check for vulnerabilities and flaws. It’s not just about ensuring your code is error-free; it’s about building trust in your platform. A well-audited smart contract layer will go a long way in attracting and retaining users.

Set the Fee Structure

One of the distinct advantages of creating a DeFi aggregator is the ability to set a fee structure for the platform. This will be a critical part of your revenue model. Fees can be set for various activities like trading, lending, or staking, and they can be a flat rate or a percentage of the transaction value.

Setting the right fee structure requires a delicate balance. Set it too high, and you risk alienating potential users; set it too low, and you might not cover operational costs. This is where market research and user feedback can be invaluable, helping you identify a fee structure that is both competitive and profitable.

Test Thoroughly

Testing is a critical phase that often gets overlooked in the rush to go to market. Thorough testing ensures that all the components of your DeFi aggregator, from smart contracts to user interface, work seamlessly together. Start with internal testing within your development team to catch any obvious bugs or flaws.

Once internal testing is complete, consider moving to a testnet and inviting a select group of users to try out the platform. This “beta testing” phase will provide valuable insights into user experience, potential bottlenecks, and any security vulnerabilities that may have been overlooked. Make sure you’ve addressed all these issues before going live.

Go to Market

After all the groundwork is laid, it’s time to launch your DeFi aggregator. But a successful launch involves more than just making your platform live; it involves a well-thought-out go-to-market strategy. This should include a comprehensive marketing plan that covers social media, influencer partnerships, and community engagement.

Once your platform is live, the work is far from over. Constant updates, community engagement, and adapting to market needs are crucial for long-term success. This is a dynamic space, and staying ahead of trends and technological advancements will be key to retaining and growing your user base.

Why Choose Hedge3 TurnKey Solution for Your DeFi Aggregator

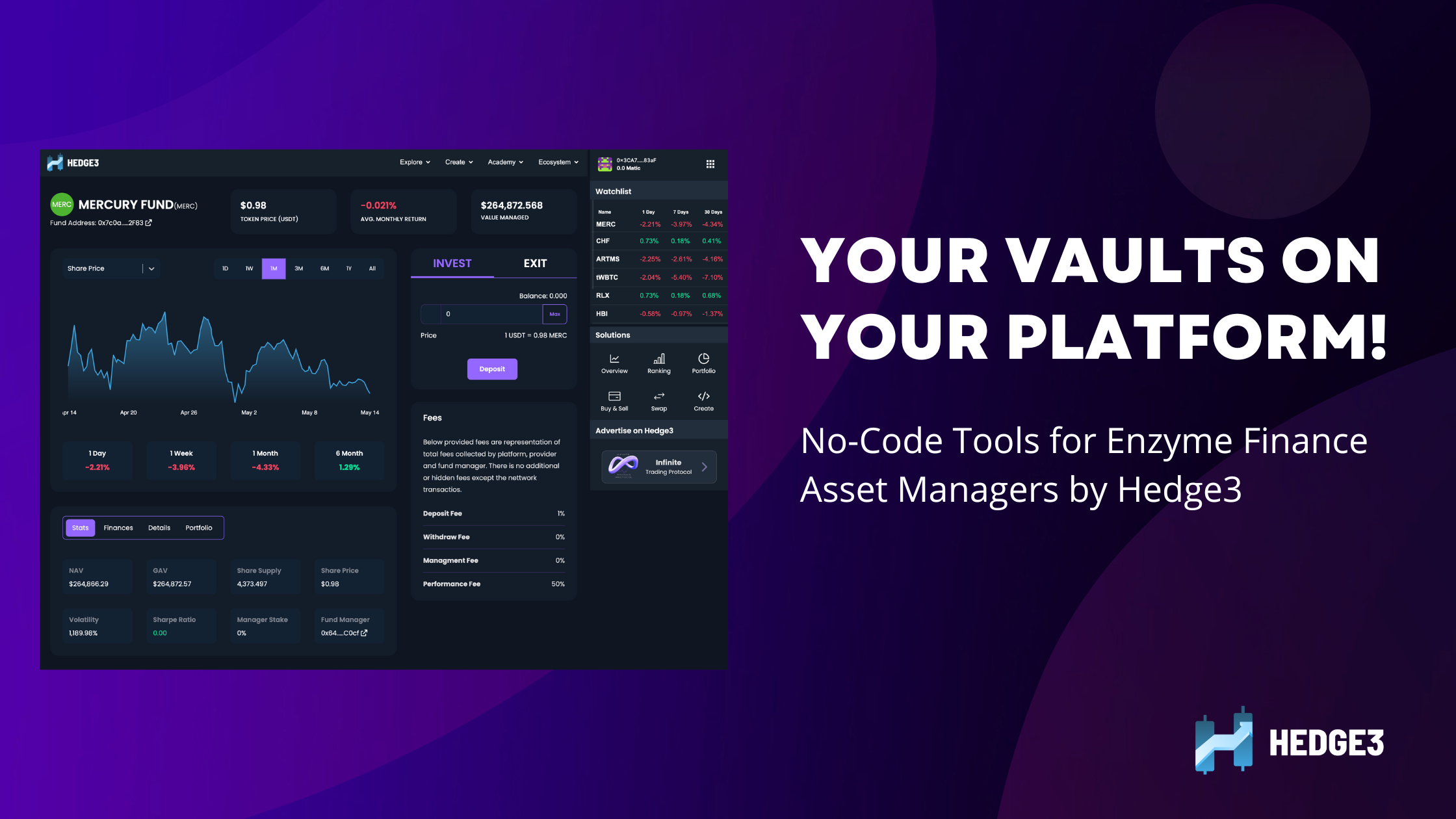

When it comes to building a DeFi aggregator, partnering with a reliable and experienced solution provider can save you both time and resources. That’s where Hedge3 comes in. We provide a turnkey solution tailored for building any type of DeFi aggregator you envision, be it DEX aggregation, lending, asset management funds, yield, LP pools, or staking aggregators.

What sets Hedge3 apart is the flexibility it offers. Not only can you aggregate various services, but you can also set your own fee structure, enabling you to start generating revenue from your platform immediately.

To find out how Hedge3 can accelerate your journey in the DeFi aggregator space, click here.