The Fascination with Cryptocurrency Investments

Passive cryptocurrency investments have become increasingly popular due to their potential for high return on investment (ROI). These digital assets are considered the future of finance, offering innovative ways to transact and invest. Cryptocurrencies leverage blockchain technology, ensuring transparency and security in financial transactions, making them attractive to investors seeking alternatives to traditional financial systems.

Their significant growth potential makes cryptocurrencies interesting investment vehicles, as their integration into mainstream finance continues to rise, offering substantial benefits to early adopters.

From Crypto to DeFi!

Cryptocurrencies pave the way for decentralized assets, presenting a stark contrast to traditional centralized financial systems where entities like banks and exchanges control user funds. Instances like the FTX collapse underscore the risks of centralized platforms, emphasizing the need for asset control in the user’s hands.

In the realm of decentralized finance (DeFi), individuals maintain autonomy over their assets, mitigating the risk of institutional failure and promoting trust and security in the investment landscape. To effectively participate in this decentralized world, understanding the importance of non-custodial wallets and DApps becomes crucial, as they are the gateways to managing and securing decentralized assets.

Understanding DApps and Non-Custodial Wallets

Non-custodial wallets, like MetaMask, are vital in the DeFi ecosystem, empowering users with complete control over their assets and private keys. This autonomy enhances security and ensures privacy, pivotal in the decentralized financial space.

Decentralized applications (DApps), operating on blockchain networks such as Ethereum, provide a range of services from trading to lending, essential for a robust DeFi experience. These platforms, backed by the secure, immutable nature of blockchain technology, facilitate a trustworthy and efficient decentralized financial system, highlighting the synergy between non-custodial wallets and DApps in the ecosystem.

Passive DeFi Investment Vehicles: DeFi Hedge Funds

On-chain asset management funds, commonly known as DeFi hedge funds, offer a gateway for broad-based participation in the cryptocurrency market. These funds, known for their potential to outperform direct cryptocurrency purchases, operate with a high degree of transparency and flexibility.

They enable investors to commit funds with a minimal vesting period, supported by a fee structure that typically includes performance and management fees. By simply connecting a wallet and purchasing a single token that represents the fund, investors can effortlessly engage in the fund’s activities, making these funds an ideal solution for those seeking passive investment opportunities in the DeFi space.

Here are some famous DeFi Funds:

DeFi Marketplace

Exploring Top Asset Management Funds

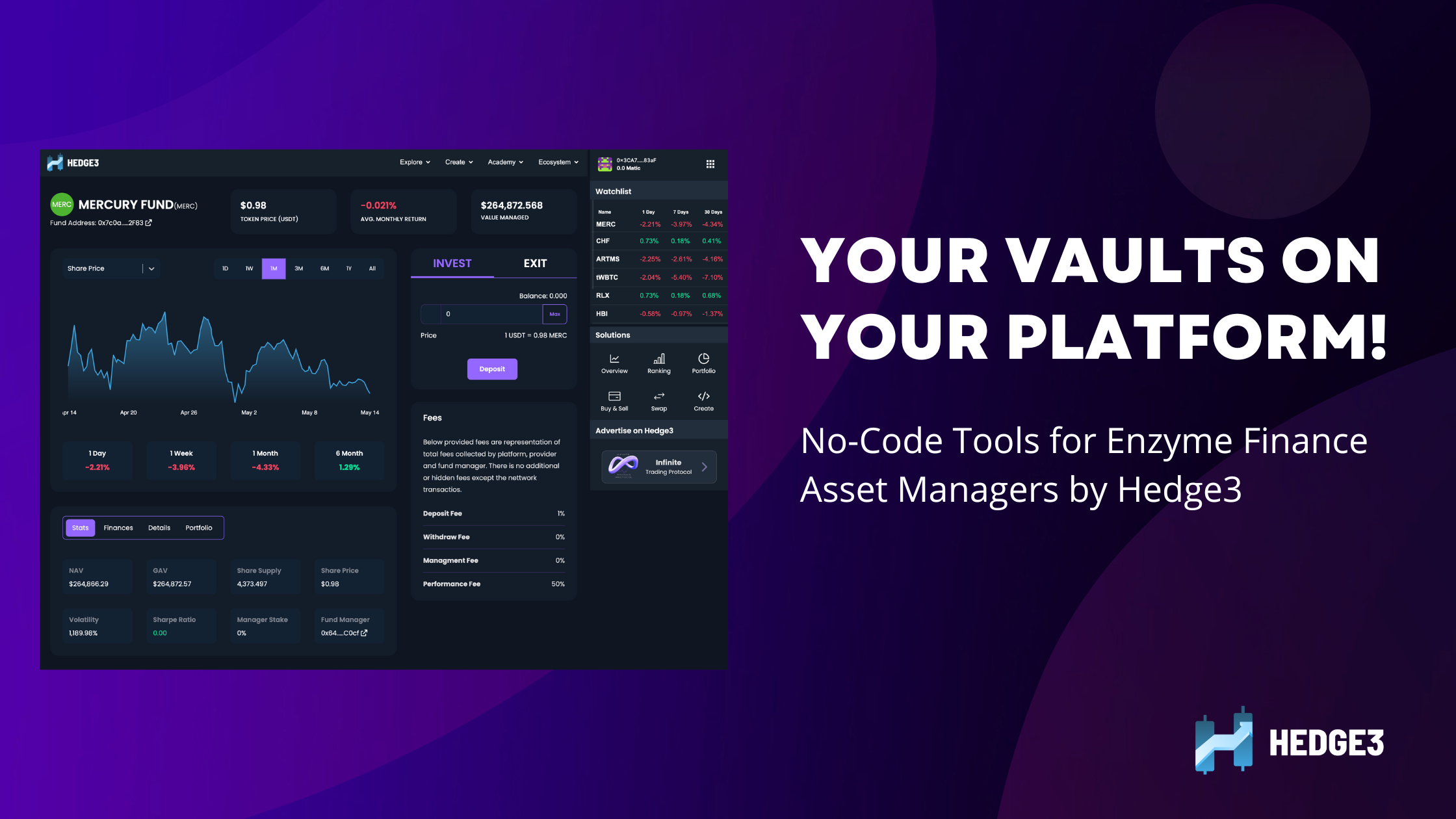

The Hedge3 DeFi Marketplace emerges as a leader in showcasing the top asset management funds across various protocols, tailored for non-technical users. It’s designed with ease of use in mind, requiring just a MetaMask wallet to access a curated selection of on-chain asset management opportunities designed for passive DeFi investments.

By providing a gateway to the best of DeFi, Hedge3 democratizes access to sophisticated investment strategies, offering a seamless experience for individuals looking to venture into the world of decentralized finance. Please note that Hedge3 merely lists these funds and does not provide investment advice; investors should conduct their own research and consider their risk tolerance before investing.