In the growing landscape of DeFi, Decentralized Hedge Funds (also known as Decentralized Asset Management Funds) are emerging as a disruptive force. These funds are built on asset management protocols and allow investors to pool their assets into blockchain-based smart contracts. Managed either algorithmically or by selected fund managers, these funds aim for high returns while capitalizing on the benefits of decentralization and blockchain security.

Decentralized Hedge Funds operate through a series of transparent and immutable smart contracts deployed on blockchain platforms such as Ethereum. These smart contracts do away with middlemen, offering a level of trust and transparency often absent in traditional hedge funds.

Investors can look under the hood by scrutinizing these smart contracts. This ensures that Decentralized Asset Management Funds are run according to pre-established rules, giving investors an added layer of trust and verification.

Financial Strategies: From Yield Farming to Arbitrage

Decentralized Hedge Funds employ a variety of financial strategies to generate returns. Among the most common are yield farming and arbitrage. Yield farming involves lending out assets to generate interest, while arbitrage capitalizes on price differentials between markets.

Just as in traditional hedge funds, Decentralized Hedge Funds can differ in their risk profiles and investment strategies. Some may focus on stable, low-risk returns, while others may seek aggressive growth. These strategies are dictated by the smart contract parameters, which should be fully understood by investors.

Governance Through Decentralized Autonomous Organizations

Governance within Decentralized Hedge Funds is typically managed by a Decentralized Autonomous Organization (DAO). This allows token holders to propose changes and vote on the fund’s operations, making the process truly democratic and community-driven.

This governance model contrasts sharply with centralized hedge funds, where decision-making is often concentrated in the hands of a few. It ensures that the interests of the majority are constantly integrated into the fund’s actions and strategies.

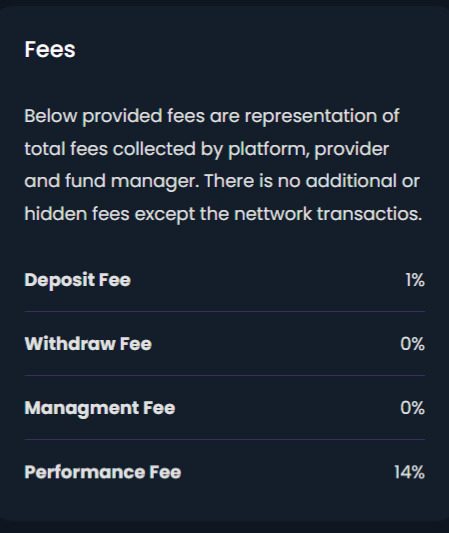

Fees and Profit Sharing in Decentralized Asset Management Funds

DeFi Fund Fee Structure Example

Traditional hedge funds often come with high fees that can significantly erode profits. Decentralized Hedge Funds, by contrast, have a lean operational model that often results in a more favorable fee structure for investors.

Performance fees are common, usually calculated as a percentage of profits generated. These are either distributed to the fund managers or offer benefits to token holders, in line with the terms set out in the smart contracts.

In addition to favorable fee structures, Decentralized Hedge Funds often eliminate many of the hidden costs associated with traditional hedge funds, such as administrative and management fees. The automation provided by smart contracts reduces the need for intermediaries, further lowering operational costs. This efficiency allows more of the profits to be returned to investors, making Decentralized Hedge Funds an attractive option for those looking to maximize their returns without being burdened by excessive fees.

The Future: Regulatory and Technical Challenges

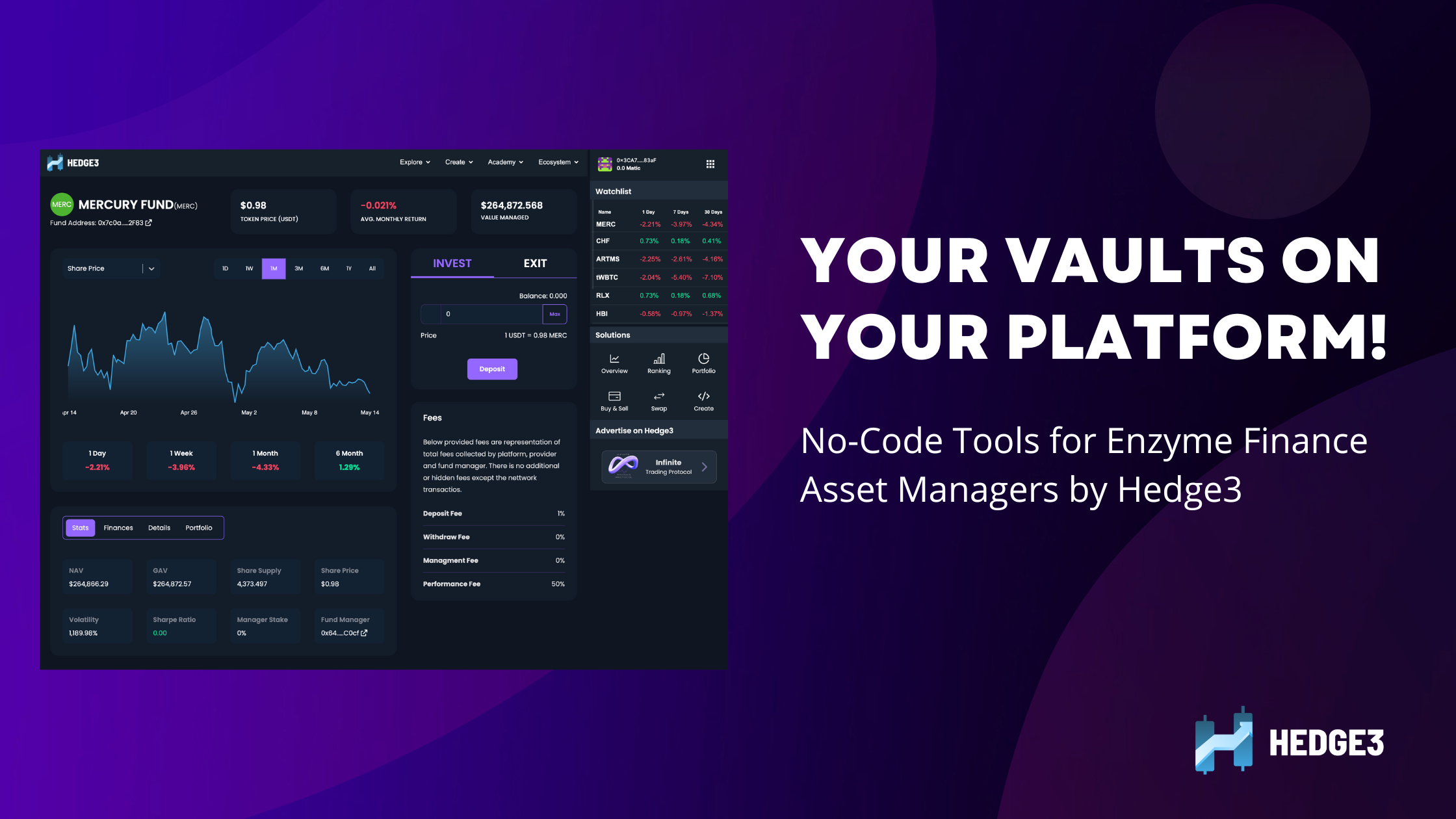

Decentralized Hedge Funds are not without challenges. These include regulatory scrutiny, potential smart contract vulnerabilities, and sometimes prohibitive gas fees. However, platforms like Hedge3 are at the forefront of solving these issues, providing a DeFi Hedge Funds marketplace that lists numerous funds from different providers such as Enzyme Finance.

As the DeFi landscape matures, Decentralized Hedge Funds are likely to overcome these challenges, making them an increasingly attractive alternative to traditional investment options. Their promise of democratized investment, transparent operations, and high returns positions them for significant growth in the coming years.

Some Well Known DeFi Funds:

If you want to be a part of the DeFi movement and already feel confident investing in different DeFi protocols, you may start your own DeFi fund. Besides, it’s not expensive, and you don’t even need an initial deposit. If you perform well, investors might be interested in your fund and deposit into it in an absolutely decentralized way. For more detailed information, read our comprehensive guide on How to Create a DeFi Fund.

The Future: Regulatory and Technical Challenges

Decentralized Hedge Funds face their share of hurdles, ranging from regulatory complications to smart contract vulnerabilities and occasionally steep gas fees. However, these challenges are being actively addressed. If you’re considering an investment in such funds, our DeFi Investment Marketplace platform serves as a gateway to various trusted options, listing a multitude of funds from esteemed providers like Enzyme Finance. Even better, using our platform is free of charge.

When you invest through our platform, you’ll deposit your assets into the chosen Decentralized Hedge Fund and receive corresponding fund tokens. These tokens represent your share of the fund and can be redeemed at any time to withdraw your investment. This mechanism not only makes the investment process transparent but also flexible, allowing you to retain control over your assets.