Decentralized Finance (DeFi) is constantly evolving, introducing more sophisticated financial tools. One such innovation is DeFi structured products, which bring a new dimension to financial strategies in the DeFi space. This article explores these complex products, aiming to provide a clear understanding for an audience already familiar with DeFi concepts.

How DeFi Structured Products Work?

DeFi structured products are advanced financial instruments created on decentralized asset management platforms. These products combine different investment tools like derivatives, options, and futures into one package, offering unique investment opportunities beyond traditional finance. They use smart contracts on blockchain technology, ensuring that everything is transparent, automated, and has less risk of one party failing to meet their obligations. The key feature of DeFi structured products is their ability to offer tailored risk and return options, meeting the needs of various investor strategies. They bring together aspects such as earning potential, protection of investment, and market-based strategies, opening new ways to earn and protect assets in the DeFi world.

Smart Contracts: The Foundation of DeFi Products

Central to DeFi structured products are smart contracts, which are automated, programmable contracts that execute when predefined conditions are met. These digital contracts run on blockchain technology, ensuring transparency, security, and immutability. Smart contracts automate the execution of complex investment strategies, eliminating the need for intermediaries and reducing operational costs.

Comparison with Traditional Financial Products

When compared to traditional financial products, DeFi Structured Products stand out for their lower entry barriers and higher potential yields. They represent a shift in investment trends, moving away from centralized systems towards more decentralized, open financial systems.

Types of DeFi Structured Products

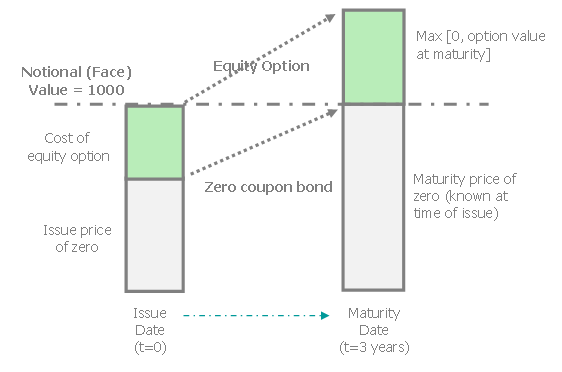

DeFi structured products come in various forms, each designed to cater to different investment strategies. Some common types include:

- Yield Generating Products: These focus on earning a return through strategies like liquidity provision or staking.

- Capital Protected Products: Aimed at preserving the principal amount while offering a chance for returns.

- Leveraged Products: Offer higher exposure to market movements, suitable for risk-tolerant investors.

Each type has its unique mechanism and risk profile, allowing investors to choose according to their risk appetite and market outlook.

Benefits and Risks

Despite their benefits, DeFi Structured Products are not without risks. They encompass credit, liquidity, and market risks, especially given the volatile nature of the underlying crypto assets. Moreover, the complexity inherent in combining structured products with crypto derivatives poses a steep learning curve, necessitating a cautious approach from investors.

Benefits:

- Customized Investment Strategies: Investors can tailor the

- eir portfolios to specific risk-return profiles.

- Efficiency and Transparency: Smart contracts automate processes and provide clear transaction records.

- Diversification: These products introduce new ways to diversify investment portfolios.

Risks:

- Market Volatility: Exposure to cryptocurrency market fluctuations.

- Complexity: Understanding these products requires a good grasp of both DeFi and traditional finance.

- Smart Contract Risks: Potential vulnerabilities in the code of smart contracts.

Future Prospects

The future of DeFi structured marketplace looks promising, with potential for growth and innovation. As the DeFi space matures, these products could become more mainstream, offering sophisticated financial solutions that bridge the gap between traditional and decentralized finance.

Conclusion

DeFi structured products are an exciting addition to the world of decentralized finance, offering tailored investment solutions. While they come with their own set of risks, their potential in diversifying and enhancing investment strategies is undeniable.