DeFi Investment Vehicles aka On-chain Investment Vehicles offer a unique blend of opportunities in the burgeoning world of decentralized finance. As we already understand the advantages and challenges associated with DeFi investments, it’s time to dive deeper into the specific mechanisms through which investors can engage with this innovative financial landscape. This exploration will unveil the diverse options available, from blue-chip tokens to yield farming strategies and beyond, highlighting how each vehicle operates within the decentralized framework to offer potential gains and opportunities for investment.

Security and Risks in DeFi Investments

The foundation of DeFi’s security lies in its protocols and smart contracts, which often undergo thorough third-party audits to ensure their integrity. However, investors face risks such as volatility, impermanent loss, and smart contract vulnerabilities. Understanding these elements is crucial for navigating the DeFi space safely.

Benefits and Opportunities of DeFi Investments

DeFi investments offer remarkable benefits, including potentially high returns, no need for registration, absence of geographical restrictions, and seamless transactions through decentralized wallets. These features make DeFi an attractive option for investors looking for efficiency and inclusivity.

With an understanding of the pros and cons of DeFi investments, let’s delve deeper into the investment mechanisms available within the DeFi ecosystem to explore the options investors have at their disposal.

Blue-Chip DeFi Tokens

Blue-chip DeFi tokens represent the most reliable and stable investment options within the DeFi space, analogous to the blue-chip stocks in traditional financial markets. These tokens are typically associated with established projects having strong fundamentals, large user bases, and significant Total Value Locked (TVL). Unlike cryptocurrencies, which function as currencies, tokens can offer additional benefits such as voting rights or a share in the platform’s fees. The performance of these tokens is closely linked to the success of their underlying protocols, making them a potentially lucrative but also more stable investment option. Investors are attracted to blue-chip tokens not only for their financial returns but also for the utility and governance features they offer, allowing for a more engaged investment experience.

Yield Farmins

Yield Farming represents an advanced DeFi strategy where investors seek to maximize their returns through the strategic allocation of assets across various protocols. By providing liquidity to DeFi platforms or engaging in staking, investors earn rewards in the form of additional tokens. This investment strategy requires a good understanding of the DeFi space and active management to optimize returns and mitigate risks, such as impermanent loss or exposure to volatile assets. Top platforms like Beefy Finance and Yearn Finance have popularized yield farming by automating these strategies, providing investors with tools to efficiently grow their investments in the DeFi ecosystem.

DeFi Indices (Index Tokens)

DeFi Indices offer a way for investors to gain exposure to a diversified portfolio of DeFi assets through a single investment, similar to how traditional ETFs work. These index tokens are managed to track the performance of a basket of DeFi tokens, mirroring the concept of traditional financial indices like the Dow Jones or NASDAQ 100 but in a fully decentralized manner. DeFi Pulse Index and Index Coop are prominent examples, offering investors a simplified and less risky means of accessing the DeFi market. Investing in DeFi Index Tokens allows individuals to spread their risk across multiple assets, making it an attractive option for those new to DeFi or looking to diversify their holdings.

On-Chain Asset Management Funds

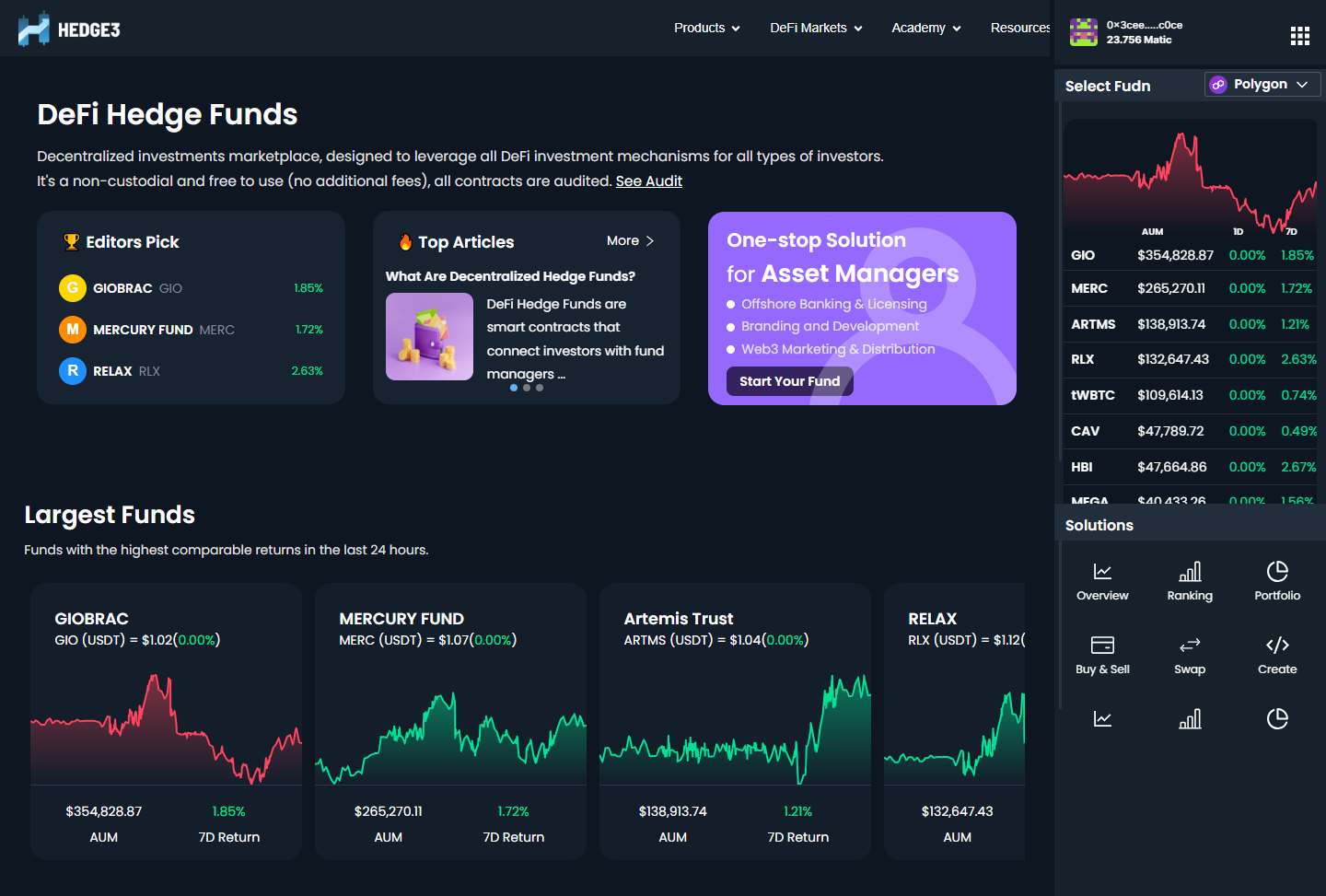

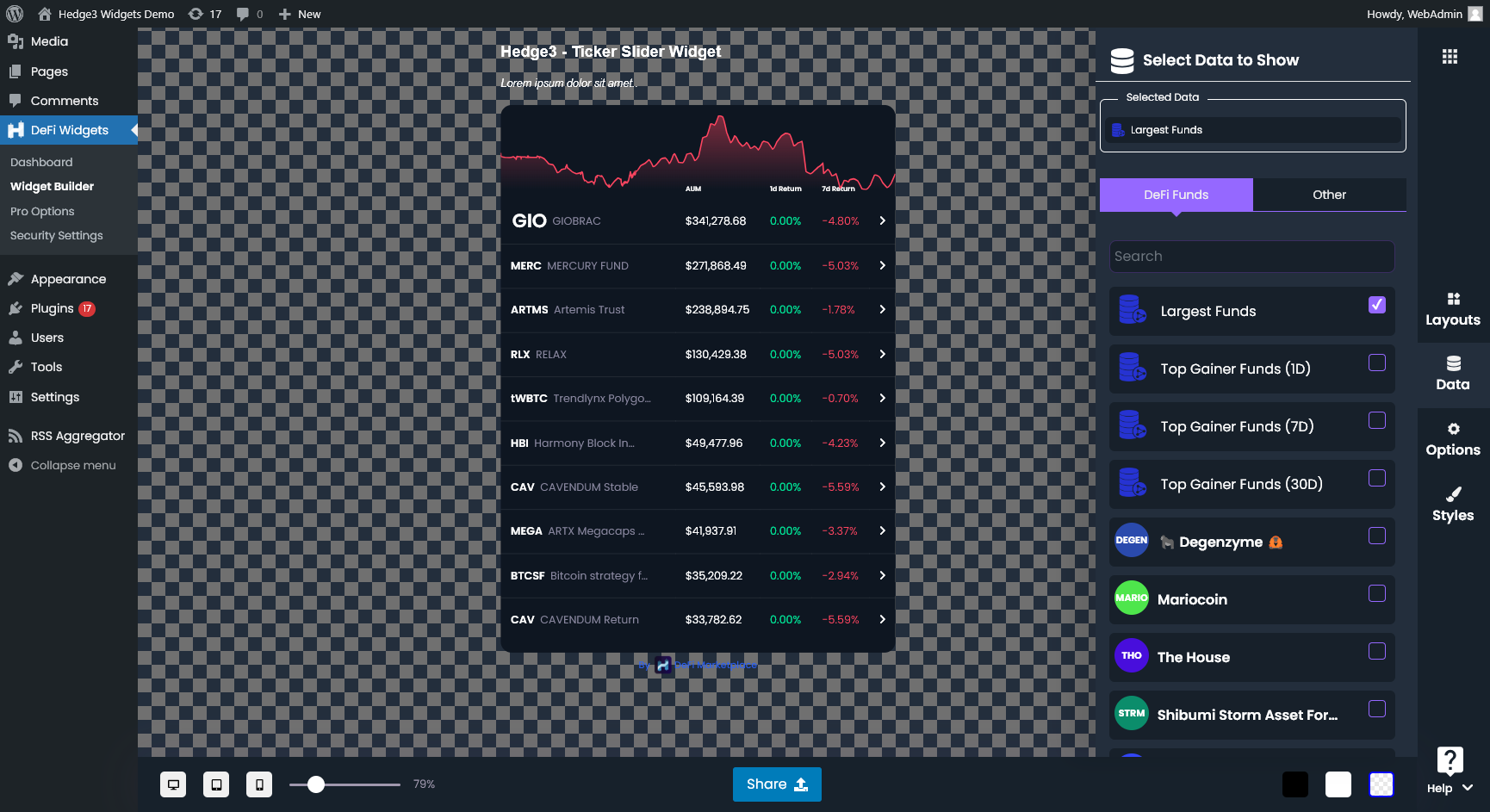

On-Chain Asset Management Funds in DeFi enable investors to have their assets managed by experienced traders and algorithms without needing to trust a central authority. Utilizing smart contracts, these platforms allow for transparent, autonomous asset management, with protocols like Enzyme Finance and dHEDGE leading the way. Investors can choose from various strategies and fund managers based on performance history, investment style, and risk appetite. This democratizes access to asset management, previously the purview of wealthy individuals or institutional investors, and offers a secure and flexible way for newcomers to navigate the complex DeFi market. Here are some Well Known DeFi Funds:

DeFi Marketplace

DeFi Real-World Assets (RWAs)

Real-world assets (RWAs) bridge the gap between blockchain and tangible assets, enabling investment in real estate, commodities, and even intellectual property through DeFi protocols. This integration expands the utility and appeal of DeFi, allowing for a more diverse range of investment opportunities beyond digital assets. Platforms specializing in RWAs, such as Centrifuge, offer tokenized versions of these assets, providing liquidity and new financial opportunities to asset owners while offering DeFi investors a way to diversify into more stable, income-generating assets. RWAs represent a significant step towards the maturation of the DeFi sector, blending traditional asset classes with innovative blockchain technology to create a more inclusive financial system.

Summing Up: The Future of Investment with DeFi

On-chain investment vehicles stand out as promising alternatives to traditional investment mechanisms, distinguished by their remarkable performance, vast opportunities, and user-friendly interfaces. The innovative nature of DeFi simplifies the investment process, making it accessible to a broader audience and offering a level of transparency and efficiency not commonly found in conventional financial systems. This paradigm shift towards decentralized finance underscores the significant potential for growth and diversification in investment strategies.

This evolving landscape is precisely why we at Hedge3 have established a DeFi Marketplace. Our platform is designed to empower users to navigate the DeFi space with ease, providing access to the best underlying protocols and investment vehicles available. By simplifying the exploration of DeFi investments, Hedge3 aims to unlock the full potential of decentralized finance for everyone, from novice investors to seasoned financial enthusiasts.