Blockchain technology has revolutionized the way we handle money, transforming wallets into digital banks and turning currencies into digital forms. Even the world of hedge funds has not been left untouched by these changes. In this evolving landscape, two major investment paradigms have emerged: crypto hedge funds and decentralized finance (DeFi) funds. Each offers distinct strategies for navigating the unpredictable cryptocurrency market, catering to different types of investors with specific needs and facing varied regulatory environments. This guide delves into their unique features, advantages, and the risks involved, aiming to provide a thorough perspective that benefits both new and experienced investors.

Crypto Hedge Funds: Combining Conventional and Cutting-Edge

Traditional crypto hedge funds, such as Pantera Capital, Grayscale, and Polychain Capital, operate much like their traditional hedge funds but focus on cryptocurrencies and blockchain technologies. These funds are managed by seasoned professionals who use sophisticated strategies to mitigate risks and enhance returns. They offer structured investment opportunities with a focus on compliance and security, adhering to stringent regulatory standards. Investments may include a range of digital assets from well-known cryptocurrencies like Bitcoin and Ethereum to smaller altcoins and tokenized assets.

The Role of Regulatory Compliance

Regulation plays a crucial role in the operation of traditional crypto hedge funds. By complying with legal frameworks, these funds provide investor protection against fraud and mismanagement, ensuring a level of security that appeals to institutional and accredited investors. This compliance includes regular audits, transparent reporting, and adherence to anti-money laundering (AML) policies.

DeFi Funds: Empowering Investors with Decentralization

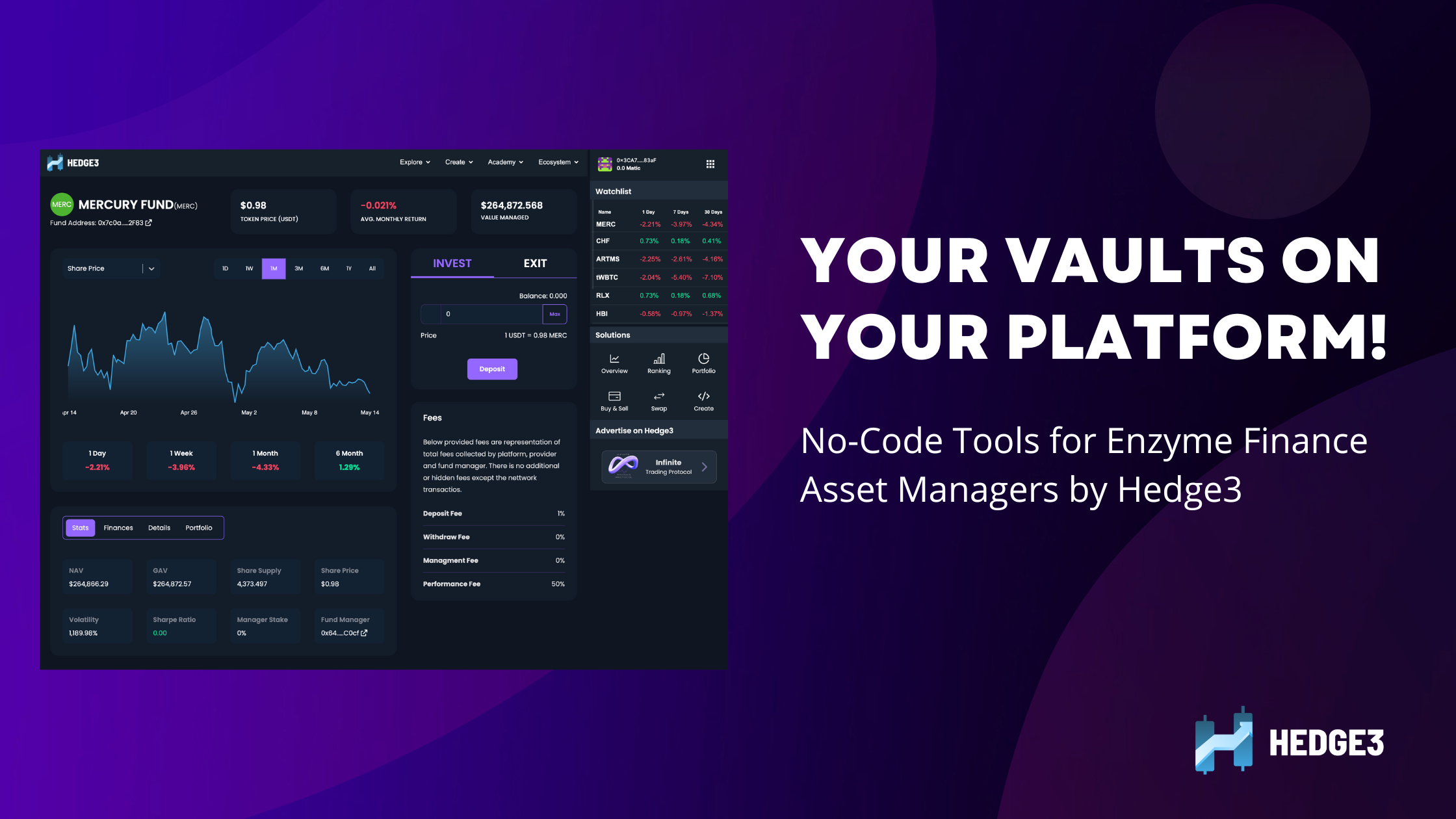

DeFi hedge funds are a new breed of investment opportunities, born from the decentralized nature of blockchain technology. These funds use smart contracts to automate and manage investments without central authority, offering unprecedented transparency and accessibility. Decentralized protocols like dHEDGE and Enzyme Finance are key players in this space, acting as launchpads for anyone to create and manage their own DeFi funds. These platforms lower the barriers to entry, making it possible for a wider audience to engage in various investment strategies, from simple yield farming to more complex algorithmic trading, or human-managed funds, all without the traditional need for intermediary institutions.

Innovation Through Technology

DeFi funds leverage blockchain technology to ensure that all transactions and strategies are recorded on a public ledger, offering unparalleled transparency. The automation of investments and withdrawals provides a seamless experience, reducing the operational costs and inefficiencies associated with traditional funds making the asset management market available for everyone.

Here are some of the well-known DeFi funds listed on Hedge3 marketplace:

DeFi Marketplace

Crypto Hedge Funds vs. DeFi Hedge Funds

Crypto hedge funds and DeFi hedge funds cater to different investor profiles through their distinct approaches to risk, management, and market access. Traditional crypto hedge funds, with their structured investment models, are particularly attractive to those seeking stability in the volatile world of cryptocurrencies. These funds enforce significant investment minimums, making them less accessible but more secure, as they are heavily regulated and typically cater to institutional or accredited investors.

In contrast, DeFi hedge funds provide an accessible and transparent alternative that allows investors to engage directly with the latest financial innovations. The decentralized nature of these funds not only lowers entry barriers but also enhances transparency, making it easy for investors to monitor fund activities and manage their investments in real-time. DeFi platforms facilitate a range of investment strategies, from yield farming to liquidity provision, offering potential high returns and new opportunities that are not typically available in traditional finance.

This comparison highlights the unique attributes of DeFi funds: their transparency, ease of investment and redemption, and the novel investment vehicles they leverage, which can provide dynamic investment opportunities in the evolving landscape of decentralized finance. To explore the top-performing DeFi funds check our Funds Marketplace!

Conclusion

Understanding the nuances between traditional crypto hedge funds and DeFi funds is essential for investors navigating the crypto space. Traditional funds offer a secure, regulated pathway into crypto investments, ideal for those accustomed to conventional finance. Conversely, DeFi funds provide a platform for innovation and active participation in fund management, suited for the tech-savvy investor looking for ground-floor opportunities in new technologies. As the financial world continues to evolve, the convergence of these models could lead to more sophisticated, accessible, and robust investment opportunities.