DeFi hedge funds, also known as DeFi asset management funds, are on-chain investment vehicles based on smart contracts and managed by humans. These funds operate on trustless protocols provided by leading third-party asset management protocols. In a DeFi fund, one person or a group manages the treasury to maximize returns, while participants can deposit their assets and receive a share of the profits. Unlike traditional hedge funds that manage cryptocurrencies, DeFi hedge funds allow anyone to participate with any amount, unless restricted by the asset manager.

This article will guide you step-by-step on how to launch and scale your DeFi hedge fund.

Getting Started with Your Decentralized Hedge Fund

To start a DeFi hedge fund, the manager must have a basic understanding of both traditional finance and DeFi protocols to succeed in a competitive environment and execute profitable trades. If you’re confident in your knowledge of decentralized asset management and looking to increase your assets under management (AUM), your first step should be launching your own Fund/Vault contract on a leading asset management protocol like Enzyme Finance, dHedge, or Velvet Capital.

Choosing an Asset Management Protocol

DeFi asset management protocols provide asset managers with the smart contract infrastructure necessary for managing investors’ assets securely. Operating a DeFi fund typically involves a pool contract where investors can deposit and withdraw assets. Building your own smart contract infrastructure is costly, risky, and time-consuming, and may not earn the trust of most investors. Therefore, leveraging the services of a well-known third-party asset management protocol is the best approach for launching a decentralized fund.

Before choosing the appropriate asset management protocol for you, consider which network you will trade on and whether you prefer to manage your assets manually or use automated strategies.

Let’s break down the asset management protocols by their pros and cons:

Enzyme Finance: Enzyme is the most well-known protocol, with the highest TVL and support for Polygon and Ethereum networks. Users can create private or public funds. Enzyme charges a management fee and a performance fee, typically ranging around 1-2% for management and 10-20% for performance. It also offers robust analytics tools and customizable investment strategies.

dHedge: Another well-known protocol for on-chain asset management is dHedge. Its competitive advantage is its SDK for automated fund management, making it the best choice if you want to automate your strategy. Like Enzyme, dHedge supports private and public fund launches and operates on Polygon, Arbitrum, Optimism, and Base networks. dHedge charges a management fee, performance fee, and entry/exit fees, providing flexibility in fee structures.

Velvet Capital: The third and youngest on-chain asset management protocol, Velvet Capital, was founded by Binance Labs and started operations on the BSC Network, recently expanding to Arbitrum. Velvet Capital offers low transaction fees and is known for its user-friendly interface. The protocol typically charges a small percentage for management and performance, making it cost-effective for new fund managers.

All these protocols’ smart contracts have undergone multiple third-party audits and have a strong track record of secure treasury management. We recommend checking the supported protocols and assets on each platform before diving into management by creating test funds or reviewing their documentation.

Management and Operations

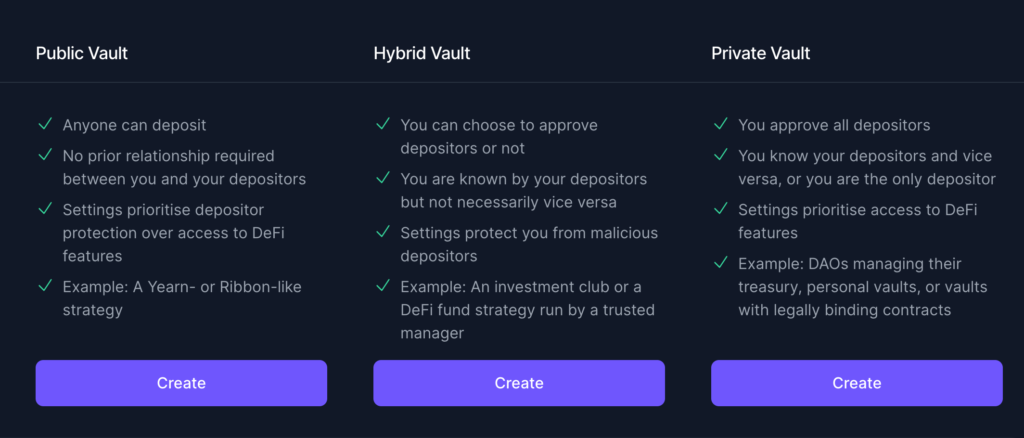

Once you have chosen an appropriate protocol for starting your on-chain fund, you must create your fund on their platforms’ UI, setting up your rules and choosing the strategy. Each platform provides different functionalities for setting up your fund’s tools. You can customize the fee structure of your operations, such as using the traditional 2% management fee and 20% performance fee, charging fees on deposits and withdrawals, or setting up any other fee structure. You can also decide whether to allow everyone or only whitelisted investors to invest in your fund.

Enzyme Finances’ Fund Policies

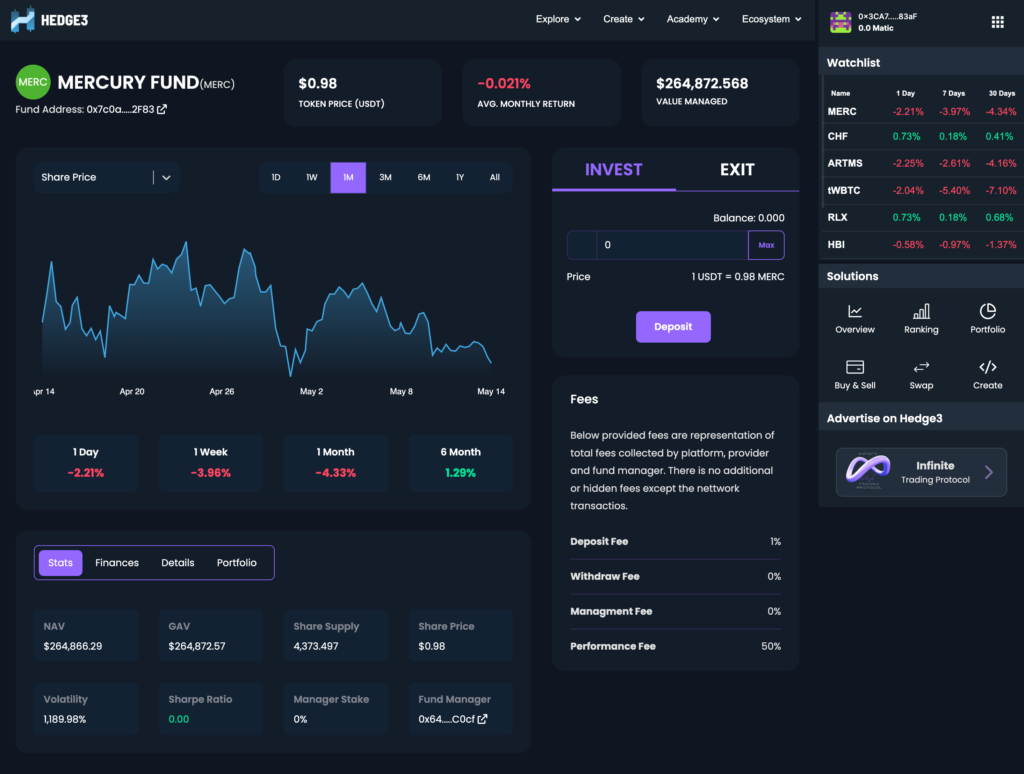

Protocols also allow you to add your social links and describe your strategy, which is highly recommended. Investors using the protocol UI will check your page and appreciate knowing about your expertise and being able to contact you through your social accounts.

Once you create and deploy your fund, it will appear on the platform’s fund marketplace and have a dedicated page with your provided information. A key aspect to focus on is your historical performance chart. From the day of fund deployment, your fund’s performance will be tracked, and this chart is a primary consideration for investors. Therefore, ensure to maintain an upward trend and be patient as your chart builds historical data.

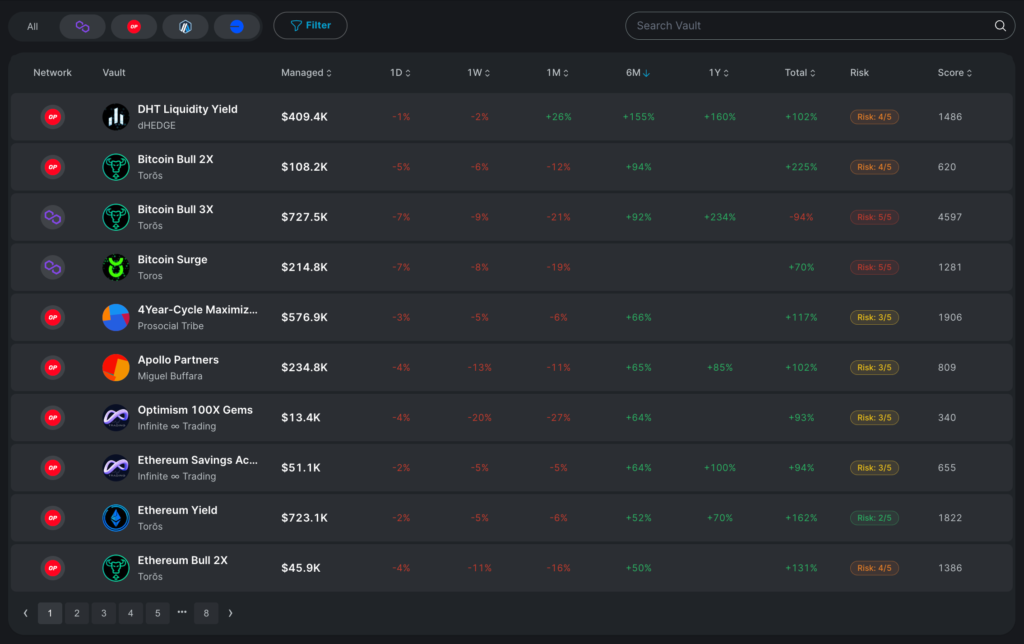

Fund Distribution and Gaining Additional AUM

As mentioned earlier, once you launch your fund’s contract, you will appear on the appropriate platform’s listing of funds so that users can explore funds by different criteria and deposit their assets into your fund. However, at Hedge3, we believe that such professional efforts should be widely spread, and investors should be able to explore the performance of all funds from all protocols and compare them in a single interface. That’s why we have created the DeFi Funds Marketplace where we list all the funds from all the protocols. Currently, we support only Enzyme Finance’s funds and will scale to other protocols in the coming months. To appear on the Hedge3 Marketplace, you need to do nothing. Once you deploy your fund, it will appear on our marketplace within the next 24 hours. However, we have some listing criteria, such as the fund should have at least $100 AUM to appear on the market (listing criteria may change).

Investors exploring the Hedge3 marketplace can directly invest their assets into your fund’s smart contract from our platform, and you will get access to these assets directly in your deployed protocol asset management system immediately!

This is another channel for gaining more AUM for your fund. However, we suggest not stopping there and making efforts to distribute your fund and your performance to a wider audience. This is why we first suggest creating a social presence for your fund and constantly posting about your performance, your place, and even your trades and decisions.

Social impact is crucial as investors want to know their assets are not only safely hosted on contracts but also smartly managed by professionals. Trust and professionalism are key indicators for investors, and to make you look like a traditional fund, we have an exciting addition for you!

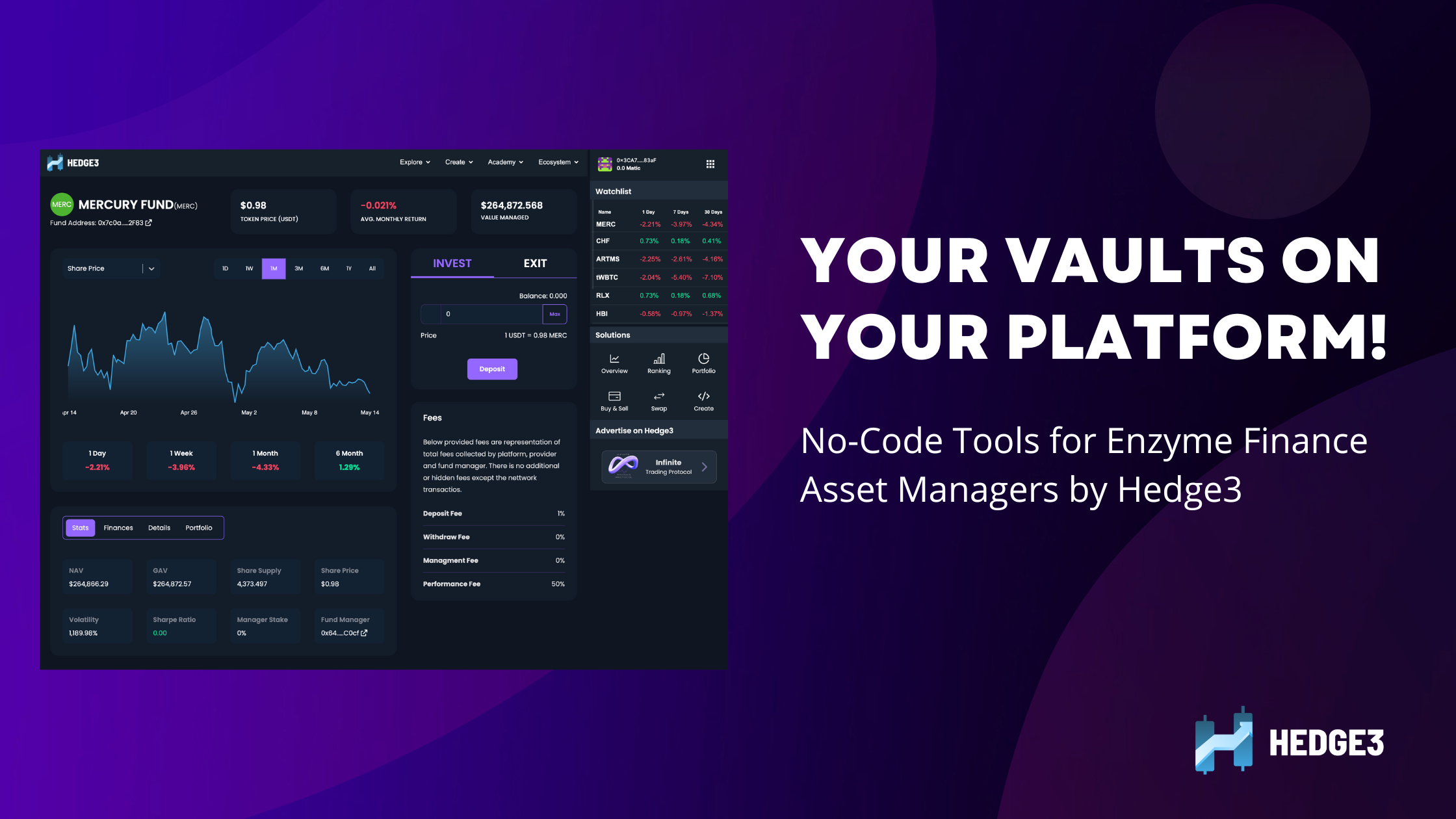

Launch Your Own On-Chain Hedge Fund Website Using Hedge3 Widgets

All traditional hedge funds and crypto hedge funds have their own websites to distribute their performance, tell their history, provide information about managers and team members, and keep an active blog about their ideas. To make this easily available for managers without putting in much effort or hiring developers, we have created Hedge3 Widgets, which allow anyone to share any fund information on their website using our builder’s no-code UI.

Here is a simple video example of how to create a widget and share it on your website:

You can now launch a simple landing page for your fund using one of the website-building tools and add a JS snippet code to share your fund’s performance. As most websites are built on WordPress, we have created a separate plugin for WordPress users, making it even more functional and easy to set up.

Now you can have your own website, show your fund’s live performance on it, and drive your website users to the Hedge3 marketplace to make investments in the fund. Moreover, we are currently working on an aggregation widget that will enable your users to deposit and withdraw from your fund without even leaving the website, so very soon, you will have a complete toolset to build your own fund website in a couple of hours.

In Q2 2024, we will also have several templates for your websites so that you can set them up even faster with ready-to-go website construction and demo pages.

Book a call with us here, or use a contact form, if you need more information about our solutions!

Conclusion

We at Hedge3 truly believe that on-chain asset management funds are one of the best choices for crypto and DeFi investors to earn passive income and avoid scam projects. This is why we support on-chain asset managers, helping them at each step of their journey to becoming real on-chain hedge funds managing millions of dollars, just like some asset managers already do. We constantly seek contact with them to identify pain points and help solve their technical problems through our solutions, making our platform even better!